Budget Template Download

Click Download For Your Free Budget Template

How to use this budget

Download the Free Template Above

Click the Download button above and you will receive a free budget template, a very similar one to the one I use to this day. I created this by reading the "Barefoot Investor" book by Scott Pape and applying my own twist to it. This process will require you opening multiple accounts for your different areas of spending. This can be done for free using your online banking webpage or mobile app. I have also included a personal Income Spending Flowchart, something I've used to give me an idea of where I am up to financially.

1. Update Your Income

Using you most recent paycheck update your different sources of income (if you have more than one). You can rename them to suit you. The "Total" in bold amount will update automatically. To make things easier, you'll never need to update any number which is bold.

2. Update Your Expenses

Over the course of a few weeks keep an eye on any outgoing expenses you have. Record what the expenses name is under the "Type" column. Monitor your spending on things like fuel, and food to try get an accurate amount for the "Amount" Column. The "Account" Column is for what bank account you are to use. I have multiple accounts I use to break things up, I have a separate account for Fuel, Food, Bills, Savings, Date Nights, and Spendings. Keeping these separate helps me track whether I am still within budget.

3. Assign Your Remaining Income

Now that you know you income, and you subtract an accurate list of your expenses, you'll know how much money you have left for spendings, savings and dates. Assign the remainder of your money until the "Total spare" amount is zero. This ensures you have accounted for every last dollar of your paycheck.

4. Transferring Into Your Bank Accounts

Now that you have done all the hard work, this section of the budget should update automatically for you. This shows you how much money you need in each of your accounts each time you get paid.

5. Refer To Your Savings Estimates

Most of us have short and long term savings goals. For me I needed to replace furniture, save for lawyer fees, and buy a house eventually. This is how I forecasted how long it would take to save based on how much I was putting in my savings account. These are preconfigured to provide monthly estimates based on fortnightly saving. Adjust the formula's to fit your specific situation. Please reach out if you need a hand with this.

6. Update Your Remaining Loan Amount Periodically

As you pay down your remaining debts you can update the remaining amount here. This is a good motivator to remind you that every pay you are getting more and more out of debt.

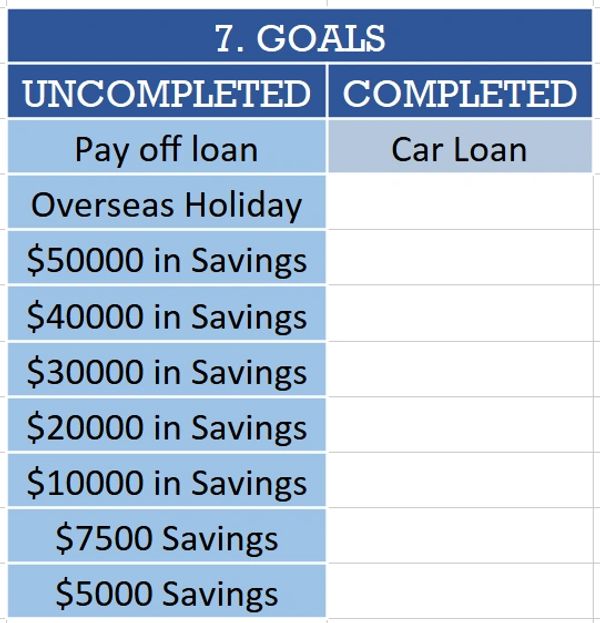

7. Achieve Your FInancial Goals and Freedom

Congratulations, if you've made it this far you have taken a tremendous first step towards achieving your financial goals.